Depositing checks

Lifecycle

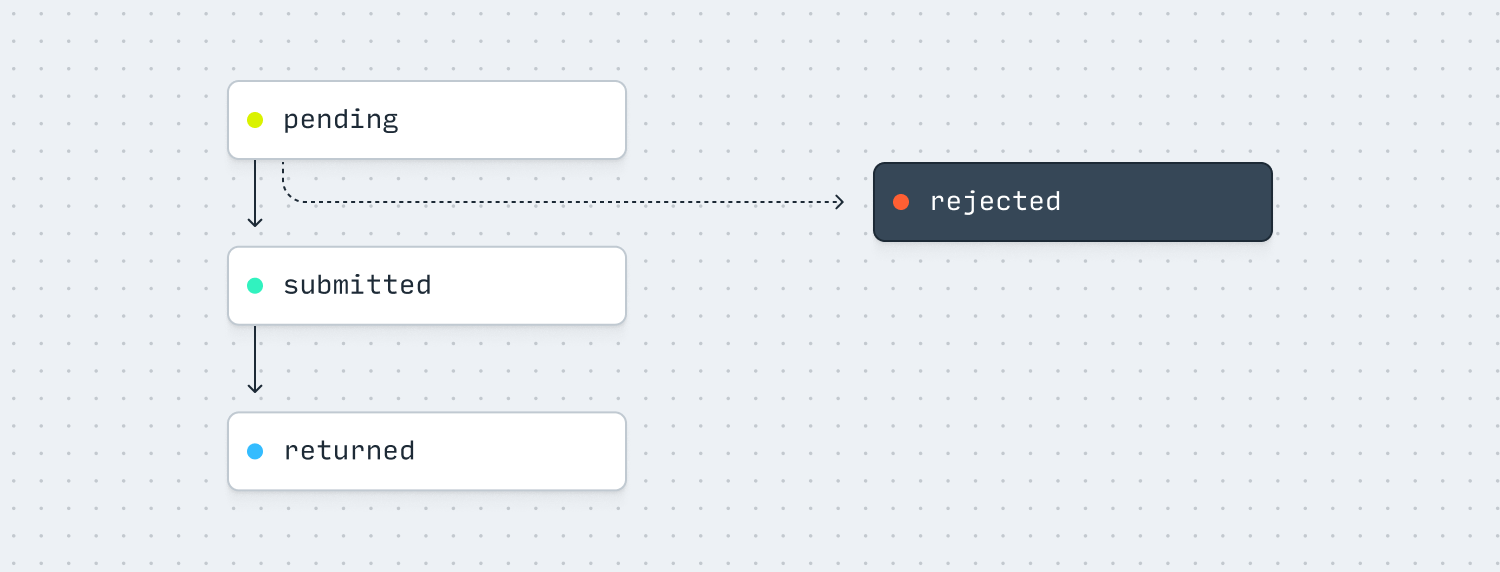

| Status | Description |

|---|---|

pending | The Check Deposit is pending review. |

submitted | The Check Deposit has been deposited. |

rejected | The Check Deposit has been rejected. |

returned | The Check Deposit has been returned. |

Depositing a Check with Increase

Depositing a Check via the Increase API kicks off several steps involving you, Increase, the Federal Reserve, and the receiving bank.

- You make a

POST /check_depositscall with the details of the deposit amount and images of the check. A Check Deposit is created with a status ofpending. - A Pending Transaction is immediately created for the full amount of the deposit.

- The check images are processed and reviewed by an Increase operator. Upon successful processing, the Check Deposit object updates with its

deposit_acceptancedetails. - When the file is submitted to the Federal Reserve, Increase updates the Check Deposit object with its

deposit_submissiondetails and the status is updated tosubmitted. - A Transaction is immediately created for the full amount of the deposit and the Pending Transaction is marked as

complete. - If a Return is received from the originating bank, the Check Deposit object is automatically updated with

deposit_returndetails and the status is updated toreturned. A new Transaction is created to decrement funds from the Account.

Reviews and rejections

All check deposit images are processed and reviewed by an Increase operator. This includes validation of the account number, routing number, amount, and serial number. If there is invalid information or an issue processing the check image, the Check Deposit object status is updated to rejected. The Pending Transaction updates to complete, no Transfer information is submitted to the network, and no additional Transactions are created.

Lockboxes

If you’d like to deposit checks received via mail, see the Lockboxes guide.